NATURAL HEALTH TRENDS (NHTC)·Q4 2025 Earnings Summary

Natural Health Trends Swings to Net Loss as Revenue Declines 10% YoY

February 4, 2026 · by Fintool AI Agent

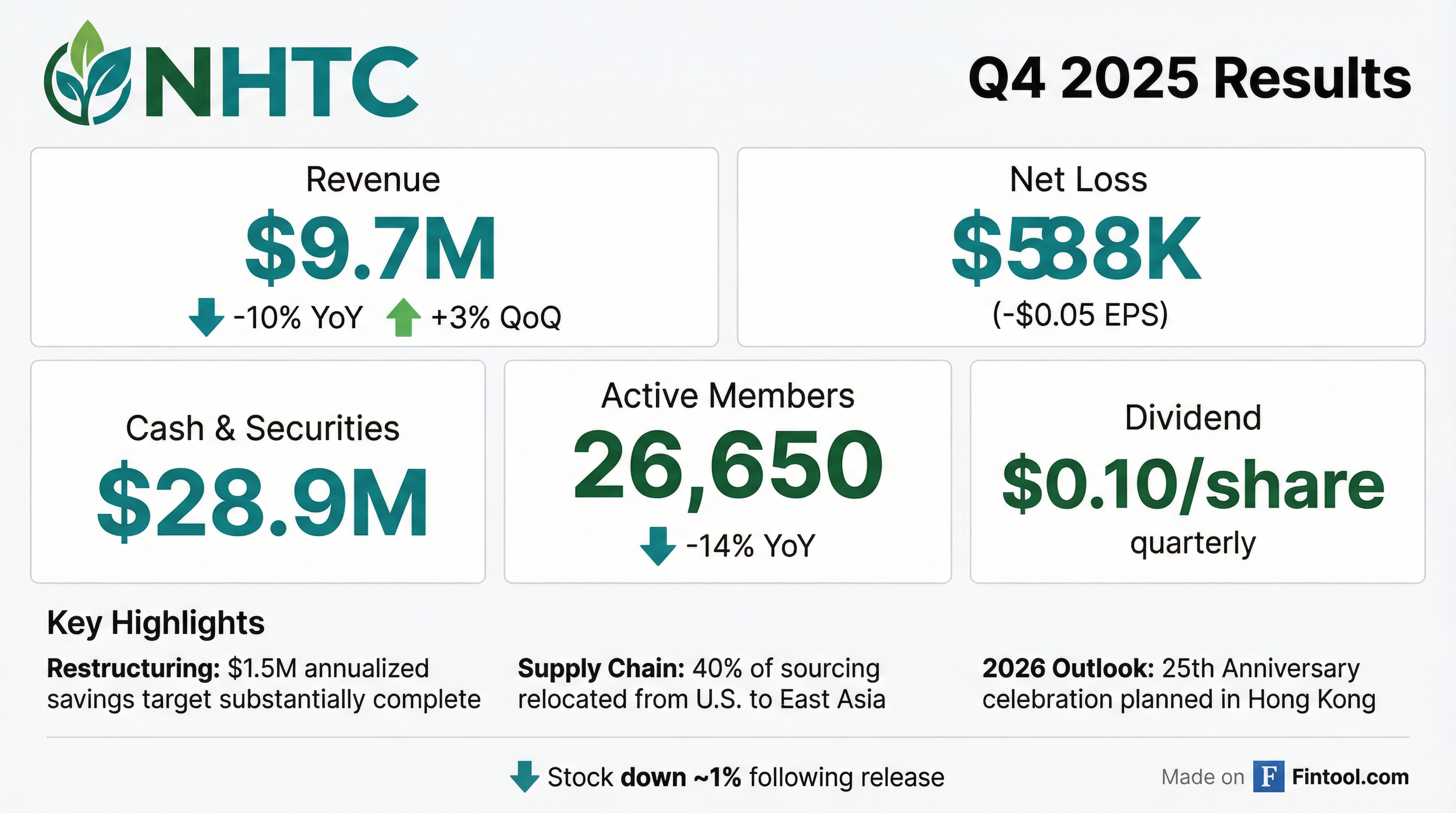

Natural Health Trends Corp. (NASDAQ: NHTC) reported Q4 2025 results with revenue declining 10% year-over-year to $9.7 million, though improving 3% sequentially. The direct-selling company swung to a net loss of $588,000 ($0.05 loss per share) compared to net income of $176,000 ($0.02 EPS) in the year-ago quarter, driven by restructuring charges and higher foreign tax expense.

Did NHTC Report a Profit This Quarter?

No. Natural Health Trends reported a net loss of $588,000 in Q4 2025, a significant reversal from net income of $176,000 in Q4 2024.

Key Performance Metrics:

The operating loss included $283,000 in restructuring-related charges. Excluding these, operating loss would have been $352,000. Despite the pre-tax loss, the company recognized $175,000 in tax expense due to higher foreign tax obligations.

What Did Management Say About the Quarter?

President Chris Sharng acknowledged the challenging environment but highlighted operational improvements:

"In the fourth quarter we managed to achieve a 3% sequential increase in revenue despite the difficult macroeconomic environment and continued pressure on consumer sentiment. We have substantially completed the major restructuring initiatives announced last quarter and expect to realize most of the associated $1.5 million annualized cost savings in the coming year."

Management also noted strategic supply chain moves:

"We also relocated about 40% of our total product sourcing base from America to East Asia, much closer to our main markets, to reduce tariff uncertainty and streamline logistics."

How Is the Business Trending Over Time?

8-Quarter Revenue Trend:

Revenue has declined for four consecutive quarters, falling from $10.8M in Q4 2024 to $9.7M in Q4 2025. The Active Member count has dropped 14% year-over-year to 26,650, signaling ongoing challenges in the company's direct-selling network.

Geographic Performance in Q4 2025:

Management noted that reorders as a percent of total orders increased compared to 2024, and Q-rated product bundles rose 10% for the full year—reflecting continued member engagement and demand for core products.

What Is the Full Year Performance?

FY 2025 vs FY 2024:

The full year 2025 marked a return to net losses after 2024's profitability, with revenue down 7% and operating losses widening 38%.

How Did the Stock React?

NHTC shares traded down approximately 1% following the earnings release, closing at $3.75 on February 3, 2026. The stock has been trading in a range of $2.40 to $6.00 over the past 52 weeks and is currently below its 200-day moving average of $4.20.

What Is the Balance Sheet Position?

The company maintains a solid cash position despite operating losses:

Cash burn was significant in 2025, with net cash used in operating activities of $6.0 million compared to $3.4 million in 2024. Q4 cash usage of $959,000 was primarily driven by restructuring-related activities and payments related to a new back-office system implementation. However, the Tax Act liability is now fully paid, which removes a significant cash obligation going forward.

What About Capital Returns?

The company maintained its quarterly dividend despite the net loss:

"On February 2, 2026, the Company's Board of Directors declared a quarterly cash dividend of $0.10 on each share of common stock outstanding. The dividend will be payable on February 27, 2026 to stockholders of record as of February 17, 2026."

In FY 2025, the company paid $9.2 million in dividends, roughly equivalent to 2024's $9.2 million. At the current share price of $3.75, the $0.40 annual dividend represents a yield of approximately 10.7%.

What Is the Outlook for 2026?

Management highlighted the company's 25th Anniversary as a potential catalyst:

"Looking ahead, 2026 marks our 25th Anniversary, a significant milestone for the Company. We have prepared an exciting program, including a big celebration in Hong Kong where we anticipate 1,500 attendees from around the world, signature products and incentives to leverage these moments effectively, and we are focused on making this anniversary a catalyst for renewed momentum."

Key 2026 Catalysts:

- Restructuring Savings: $1.5M annualized cost savings expected to be realized

- Supply Chain Optimization: 40% of sourcing now in East Asia, closer to key markets

- 25th Anniversary Event: Hong Kong celebration with 1,500 expected attendees

No formal financial guidance was provided for 2026.

Key Risks and Concerns

- Declining Active Members: Down 14% YoY to 26,650, the lowest level in recent history

- Revenue Pressure: Four consecutive quarters of YoY revenue declines

- Cash Burn: $6.0M used in operations in FY 2025, eating into the cash cushion

- Dividend Sustainability: $9.2M annual dividend vs negative operating cash flow raises sustainability questions

- Macroeconomic Headwinds: Management cited "difficult macroeconomic environment and continued pressure on consumer sentiment"

Bottom Line

Natural Health Trends reported a disappointing Q4 2025 with revenue down 10% YoY and a swing to net loss from year-ago profitability. The silver lining: restructuring is substantially complete with $1.5M in expected annual savings, the supply chain has been repositioned closer to key markets, and the balance sheet remains debt-free with $28.9M in cash and securities. However, declining Active Members remain the core issue, and the sustainability of the 10.7% dividend yield is questionable given negative operating cash flow. The 25th Anniversary celebration in Hong Kong represents management's hope for a turnaround catalyst, but execution will be key.

Note: NHTC has no analyst coverage, so beat/miss comparisons to consensus estimates are not available.

Related Links: